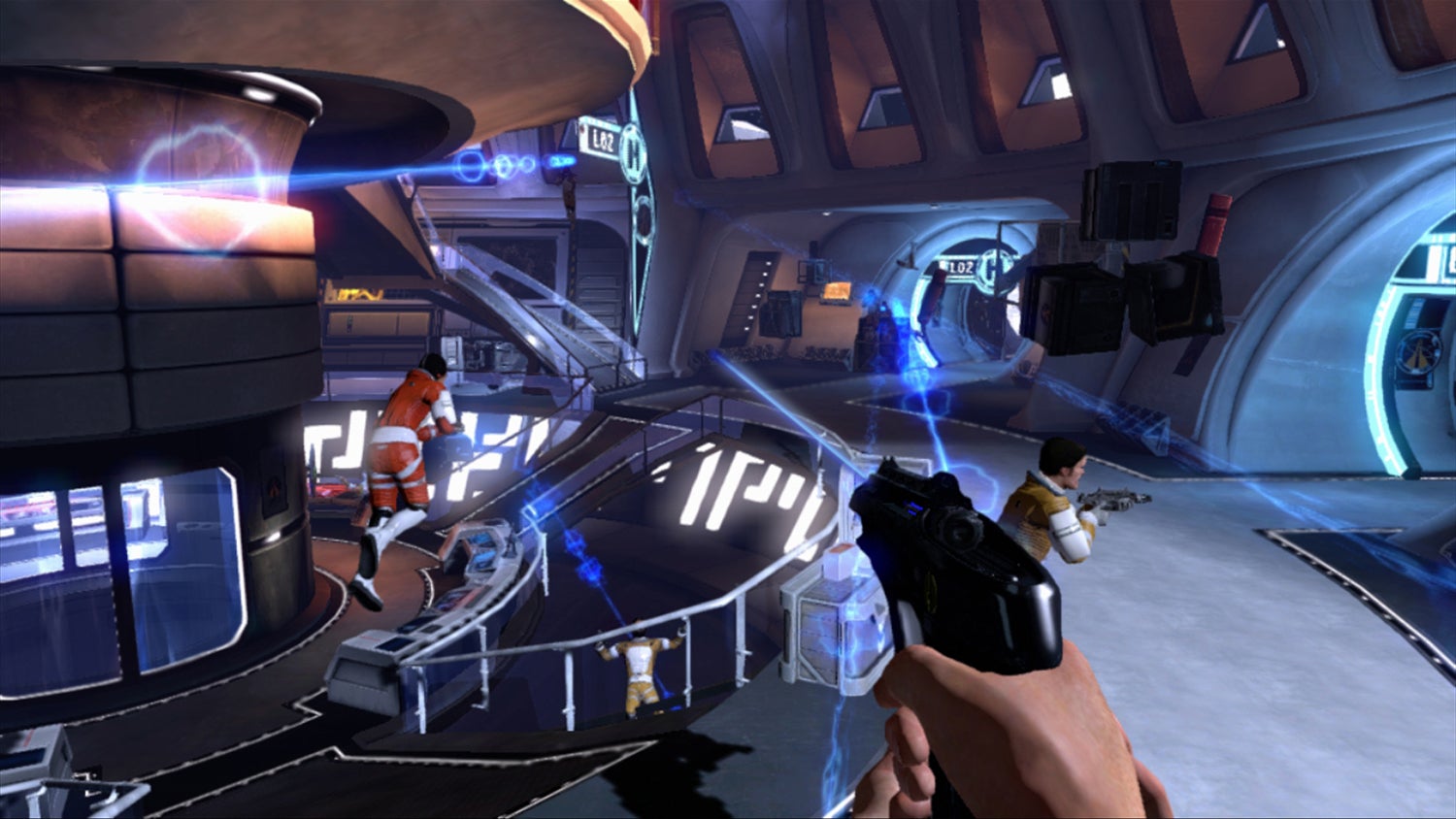

James Bond 007 Legends (2012)

:popis

Žánr: Akčná

Datum vydání: 2. November 2012

Stránky hry: www.007legends.com

Výrobce: Activision, Eurocom

Hra ku príležitosti osláv 50. výročia legendy s menom James Bond, v ktorej sa prenesiete späť v čase do najznámejších a napínavých tajných misií agenta 007 z populárnej filmovej série Bondoviek.

007 Legends ponúka originálny a komplexný príbeh spájajúci šesť klasických Bondoviek, vrátane tej najnovšej s menom Skyfall. Rovnako ako vo filmoch, sú hráči vybavení rôznymi špiónskymi vynálezmi a arzenálom zbraní, vrátane legendárnej pištole Walther PPK. Nechýbajú naleštené šporťáky, s ktorými budeme vykonávať pôsobivé kúsky, navštívíme množstvo exotických miest, kde sa stretneme s notoricky známymi protivníkmi a ich prisluhovačmi a samozrejme... zoznámime sa i s nádhernými ženami.

Vedľa príbehovej kampane sa vracajú tiež populárne single-playerové Mi6 Ops misie, ktoré sa po prvý krát objavili v GoldenEye 007: Reloaded, kde si vôbec po prvý krát môžete zahrať i za niektorých z Bondových nepriateľov. A čaká na vás tiež masívny multiplayer zahŕňajúci lokálny režim pre 4 hráčov na rozdelenej obrazovke a online režimy s novými mapami, zbraňami a postavami inšpirovanými 50. ročnou históriou Bondoviek.

Alternativní názvy

James Bond: 007 Legends

Minimální požadavky

Windows XP / Vista / 7

Intel Core 2 Duo E6600 / AMD Phenom X3 8750

2 GB RAM

10 GB miesta na disku

512 MB, Shader 3.0 grafická karta (Nvidia GeForce 9600GT / ATI Radeon HD 3870)

DirectX 9.0c kompatibilná zvuková karta

DirectX 9.0c

[youtube] http://www.youtube.com/watch?feature=pl ... x9cOcNyphM [/youtube]

to neni muj upload a doporučuji ja ji dohral a je dobra

Komentáře

Přehled komentářů

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

LamaExogy,7. 7. 2024 0:00

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,6. 7. 2024 10:01

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,6. 7. 2024 4:33

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,5. 7. 2024 17:51

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,5. 7. 2024 10:25

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

LamaExogy,5. 7. 2024 6:49

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

LamaExogy,5. 7. 2024 2:15

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

LamaExogy,4. 7. 2024 10:47

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

LamaExogy,4. 7. 2024 4:41

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

LamaExogy,4. 7. 2024 2:23

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN MONEY SEARCH SOFTWARE

LamaExogy,3. 7. 2024 22:45

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

LamaExogy,3. 7. 2024 19:53

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

LamaExogy,2. 7. 2024 6:43

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN LOTTERY - SOFTWARE FREE

LamaExogy,2. 7. 2024 4:53

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,1. 7. 2024 19:12

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BITCOIN CRACKING SOFTWARE

LamaExogy,1. 7. 2024 12:52

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

SEARCHING FOR LOST BITCOIN WALLETS

LamaExogy,1. 7. 2024 8:40

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

LamaExogy,1. 7. 2024 6:02

I want to show you one exclusive program called (BTC PROFIT SEARCH AND MINING PHRASES), which can make you a rich man!

This program searches for Bitcoin wallets with a balance, and tries to find a secret phrase for them to get full access to the lost wallet!

Run the program and wait, and in order to increase your chances, install the program on all computers available to you, at work, with your friends, with your relatives, you can also ask your classmates to use the program, so your chances will increase tenfold!

Remember the more computers you use, the higher your chances of getting the treasure!

DOWNLOAD FOR FREE

Telegram:

https://t.me/btc_profit_search

BTC PROFIT SEARCH AND MINING PHRASES

LamaExogy,7. 7. 2024 12:53